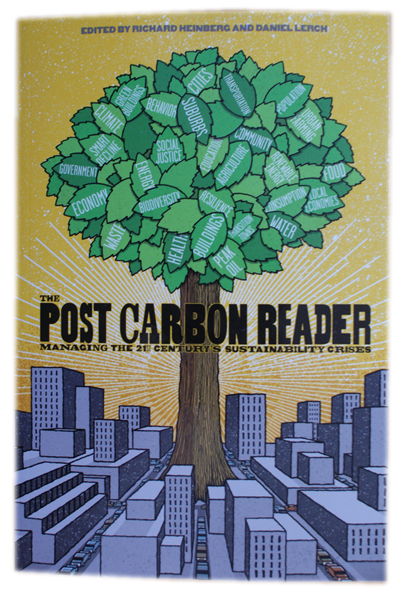

"Post

Carbon Reader", Heinberg/Lerch

"Post

Carbon Reader" är utgiven år 2010, omfattar 500

sidor och är på engelska. Den finns på AdLibris,

där den kostar bara 173 kr.

Boken

har Richard Heinberg och Daniel Lerch som redaktörer och består

av 34 olika uppsatser, med ungefär lika många författare.

Envar får alltså fokusera på just det som han eller

hon har som specialitet. Bladn de mer kända namnen återfinns

William E. Rees, Richard Douthwaite, Chris Martenson och Rob Hopkins.

Resultatet

blir en mycket koncis, faktaspäckad och klargörande bok,

värd att sätta högt på inköpslistan! Den

kunde förtjäna en översättning till svenska.

Boken

betar systematiskt av området för område, med denna

kapitelindelning:

1.

Grundläggande begrepp

2.

Klimat

3.

Vatten

4.

Biologisk mångfald

5.

Mat

6.

Befolkning

7.

Kultur och beteende

8.

Energi

9.

Ekonomi

10.

Städer och förorter

11.

Transporter

12.

Avfall

13.

Hälsa

14.

Utbildning

15.

Byggande av resilience

16.

Uppfordran till aktion

Begreppet

"resilience" är centralt, men svårt att med ett

ord översätta till svenska. Det blir ungefär elasticitet,

spänstighet, icke-sårbarhet:

Chris

Martenson:

"We

are more resilient when we have multiple sources and systems to supply

a needed item, rather than being dependent on a single source. We

are more resilient when we have a strong local community with deep

connections. We are mroe resilient when we are in control of how our

needs are met and when we can do things for ourselves.

We

are more resilient if we can source water from three locations...

We

are more resilient when our home can be heated by multiple sources

and systems,.."

Uppsats

nummer 19, av Tom Whipple - "Peak Oil and the Great

Recession" - känns särskilt aktuell:

"This

chapter explores the relationship - as it is understood thus far -

between the peaking of oil production, which started around 2005,

and the current global recession, which officially started in late

2007."

"...

world production - which has been growing steadily for nearly 150

years - has flattened out in the vicinity of ... 86 million bpd, suggesting

to many that all-time-peak-oil production has already occured."

"Corporate

loobying and public realations became industries unto themslves, and

corporate political contributions skyrrocketed. Today the power of

very weel-financed 'special interests' to influence the political

response to major issues... is a well-established part of the American

political scene."

"By

2007-2008 it was obvious that a major economic crisis was under way,

with falling real estate values, increasing underemployment, sagging

economies, and unstable, overleveraged financial markets.... the role

of oil in deepening and spreading the global recession has only recently

begun to be appreciated."

"Oil,

which was trading for as low as $ 20 a barrel in 2002, reached $ 70

a barrel in 2006, increased to $ 80 a barrel in late 2007, and topped

$ 100 at the beginning of 2008."

"The

$ 60-per-barrel increase in oil prices between 2002 and late 2007

meant that $ 1.2 billion additional each day - or $ 36 each month

- was being spent in the United States solely to pay for the increased

cost of oil.

The

year 2008 will be remembered as a major turning point in industrial

history, for it was the first year when the world got a taste of the

unpredictable price spikes that come from inadequate oil supplies."

"Two

major lessons from the first half of 2008 were that oil prices can

indeed increase rapidly to unanticipated levels and that very high

prices will cause serious economic damage in short order."

"Most

new oil production is now coming from deep-water wells or deposits

of heavy oil in Canada and Venezuela, which require very large investments

to exploit."

"...new

oil resources are becoming so expensive to find - and new oil production

is becoming so expensive to develop - that it will take relatively

high prices to keep exploration and new production projects viable."

"It

is unlikely that there will ever be an economic recovery in the conventional

sense; the economic downturn is likely to continue in one form or

another for many years."

Sammanfattningsvis:

bakom recessionen som kom kring år 2008 låg kraftigt höjda

oljepriser. Det blir därför osannolikt att en återhämtning

kommer att ske till något vi varit vana vid.

Jan

Milld

oktober

2011